Introducing CIRA-V2: Upgrade to China Investor Relations Activity Analytics

We’re excited to share the launch of CIRA-V2 (China Investor Relation Activities Analytics - V2), a major upgrade to our dataset that provides raw transcripts and deeper insights into the information disclosure practices of Chinese listed companies. This enhanced version is designed to support professionals like analysts, portfolio managers, and researchers who rely on detailed, accurate, and actionable market data.

Investor relations (IR) activities in China are an essential window into how companies communicate with the market. For A-share listed companies, regulators mandate disclosure of three key types of IR events: Investor Interaction Platforms (IIP), Online Roadshows (ORS), and Company-Reported IR Activities (CRA). These events reveal not only a company’s communication strategies but also important clues about investor sentiment and emerging market trends.

Our CIRA dataset was developed to systematically capture and analyse these disclosures, bridging a critical information gap for those focused on the Chinese capital market. With CIRA-V2, we’ve expanded the dataset’s scope, improved the quality of analytics, and introduced new features to make it even more powerful and user-friendly.

About CIRA

CIRA (China Investor Relation Activities Analytics) is a specialised database that focuses on the unique information disclosure practices of the Chinese market. Unlike other markets, where institutional investors dominate, China’s retail investors play a critical role in shaping market dynamics. To facilitate this engagement, the CSRC has established a highly structured IR framework, which Datago captures and organises into actionable datasets.

The CIRA database focuses on 4 key types of IR activities, reflecting the core mechanisms of corporate-investor communication in China:

1. Investor Interactive Platforms (IIP)

The Shenzhen and Shanghai Stock Exchanges have launched investor interaction platforms to facilitate direct communication between companies and investors, particularly retail investors. Each listed company has its own community on these platforms, where investors can post questions or express opinions about corporate operations and governance.

Typically, a company’s board secretary is responsible for responding to these inquiries within 2 business days. These exchanges provide valuable insights into how companies manage investor relations and address shareholder concerns.

2. Company-Reported IR Activities (CRA)

Listed companies are required to disclose summaries of private and public IR activities, such as site visits, roadshows, and investor days. These reports include detailed information, such as the event date, participants, location, duration, and a summary of the Q&A discussions.

Regulators enforce strict timelines for these disclosures: companies listed on the Shenzhen Stock Exchange (SZSE) must publish within two trading days, while those on the Shanghai Stock Exchange (SSE) follow a regular disclosure schedule.

3. Online Roadshows (ORS)

Online roadshows are a dynamic forum for real-time interaction between investors and company management. Hosted on third-party platforms like P5W, these events are often used to disclose critical information, including earnings results, IPO details, and updates on major asset restructurings.

During these sessions, investors can submit questions in real time, which management is required to address. In addition, video recordings of these events are often archived, providing a rich source of content for post-event analysis.

4. Roadshow Calendar

Before hosting a roadshow, companies may issue an announcement detailing the topic and schedule to encourage participation. While not all companies publish such announcements, those that do often provide early insights into their strategic priorities.

CIRA consolidates these roadshow announcements into a single, comprehensive calendar, enabling users to track and follow these events with ease.

Why CIRA Matters

Investor relations (IR) activities occupy a distinct and influential role within China’s financial ecosystem. Unlike many global markets, Chinese A-share companies are mandated to disclose IR events through specific regulatory channels. This structured transparency offers a rare lens into how companies engage with investors and strategically present themselves to the market.

Beyond surface-level disclosures, these events often contain nuanced signals—revealing investor sentiment shifts and the company's evolving priorities. For analysts, investors, and researchers, tracking IR activities provides invaluable context for market surveillance and corporate intelligence.

To support deeper exploration, CIRA includes raw transcripts from IR activities. These transcripts empower users to conduct advanced research, apply customised analytical frameworks, and extract insights that go far beyond headline summaries.

What’s New in CIRA-V2

The release of CIRA-V2 marks a significant step forward in our ability to help you analyse the Chinese market. Here are the key improvements we’ve made:

Roadshow Calendar

One of the most exciting additions is the inclusion of company-disclosed roadshow announcements. This allows users to identify upcoming events early, making it easier to plan ahead and stay informed about key developments.Expand Coverage of Online Roadshows

We’ve significantly expanded our data sources, now capturing over 96% of all online roadshow events for A-share stocks. This means fewer gaps in coverage and more confidence in the completeness of your analysis.Streamlined Event Records

Previously, a single roadshow event might have been reported multiple times due to broadcasts on different platforms. In CIRA-V2, we’ve consolidated these into a single, unique record for each event. This makes your analysis cleaner, more accurate, and easier to handle.Enhanced Sentiment Analysis

Leveraging the latest advancements in Large Language Models (LLMs), the sentiment analysis for Q&A sessions has been upgraded. Instead of the simple “positive/neutral/negative” categories, we now provide nuanced sentiment scores that offer a more precise understanding of content.Complete Video Transcripts

We transform roadshow videos into rich text transcripts using advanced large language models (LLMs), making them accessible for text-based analysis and supporting flexible, customizable analysis.

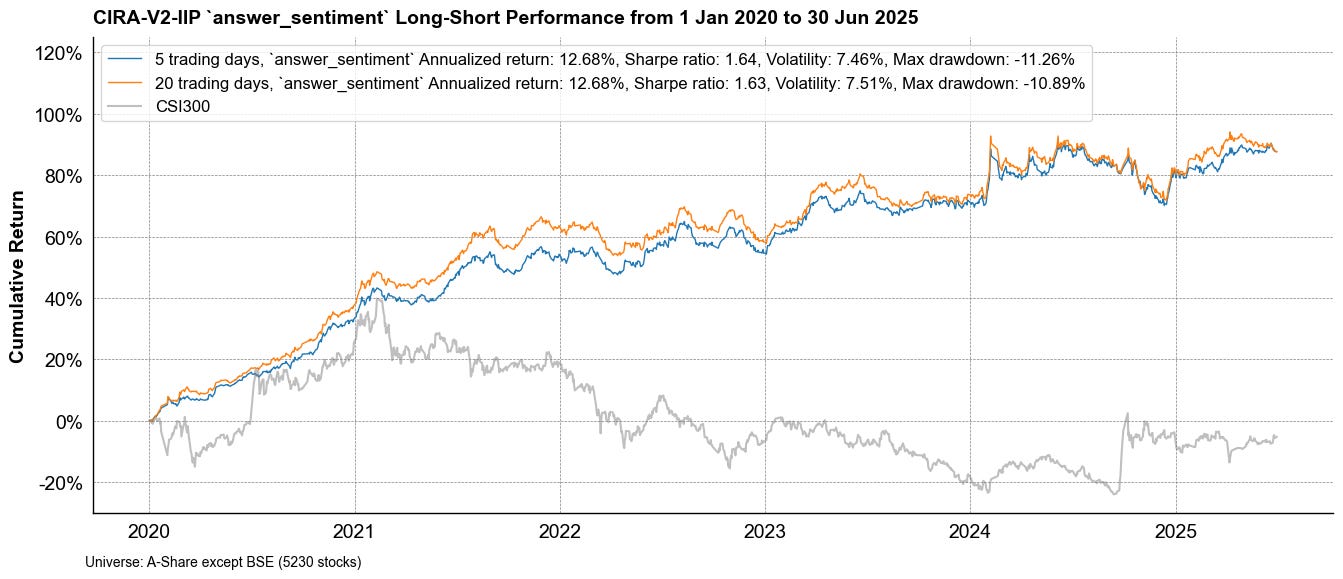

Performance

Based on our preliminary backtest results, we believe CIRA is effective for long-short strategies. For full details, please contact us to request the white paper.